ebike tax credit income limit

As it stands the bill provides a credit of 30 for up to 3000 spent on a new e-bike excluding bikes that cost more than 4000. The credit phases out starting at 75000 of modified adjusted gross income 112500 for heads of household and 150000 for married filing jointly at a rate of 200 per 1000 of additional.

E Bike Incentive Programs In North America N Eurekalert

The halving of the incentive is sadly not the only revision reports Electrek.

. The maximum annual reimbursement an employee could receive tax-free would jump from 240 to over 600. The power rating will likely be updated to read not more than 750 watts to better align with current e-bike laws in the US that limit motors to a maximum of 750 watts. But if you are having a shortage of funds then its.

The E-Bike Act. Both new and used electric vehicles are eligible with MSRPs up to 60000 and 55000 respectively depending on the type of vehicle. If you purchase a bike that shares this price tag you will get a full 1500 dollars credit and cut the overall cost of that bike to 3500 dollars.

Better off buying now than waiting for government incentives and if youre lucky enough to take advantage of the tax credit you can buy some accessories for your bike with it. Your tax professional can help you understand the difference. About Form 8936 Qualified Plug-In Electric Drive Motor Vehicle Credit.

250000 for single people. These electric bikes are known as electrically. Get a rebate of up to 2000 with the purchase of a used electric vehicle.

If you purchased a fuel cell car after January 1 st 2017 youre no longer able to claim Federal tax credits on these cars. Non-cars vans trucks SUVs need to be under 80000 to be eligible for the credit. Theres also an income limit for taxpayers to receive the credit.

And the tax saved will be somewhere between 5-30 of 20000 depending on the tax slab your income falls under. Joint filers who make up to 150000 can qualify for. The E-BIKE Act creates a consumer tax credit that will cover 30 of the cost of the e-bike up to a 1500 credit.

There now also exists an income based phase out of the credit applicable to those earning over 70000 or 112500 for heads of household and 150000 if the submission is. How much tax credit would I get from the E-bike tax credit. All I am saying is dont go for a loan if you have funds available with you.

This could show up as part of your refund or as a reduction of the amount of taxes you would otherwise pay. The credit has a limit of 1500. There now also exists an income based phase out of the credit applicable to those earning over 70000 or 112500 for heads of household and 150000 if the submission is.

All others complete and attach the applicable AMT form or schedule and enter the TMT on line 5. The credits also phase out. For those who make less than 75000 as an individual or 150000 as joint.

After that it largely depended on the fuel efficiency rating of the vehicle. Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year. After you do the match the absolute price for an electric bike purchase in the eligibility years comes out to be around 5000 dollars after taxes.

It only applies to new e-bikes that cost less than 8000 and is fully refundable allowing lower-income workers to claim the credit. Also use Form 8936 to figure your credit for certain qualified two- or three-wheeled plug-in electric vehicles. The legislation would offer Americans a refundable tax credit worth 30 percent of a new e-bikes purchase price capped at 1500.

A qualifying new electric bicycle falls within the three class designation system and costs less than 8000. Cars need to be under 55000. Refundable means that individuals who do not have income.

Licensing tax and insurance. They are exempt from the AMT for tax years beginning after 2017. A 15 refundable consumer tax credit on the purchase of a qualifying new electric bicycle with a max credit of 750bike including phased restrictions on higher-income earners.

2 That means that a 7500 tax credit would save you 7500 in taxes. Today the electric car tax credit provides a dollar-for-dollar reduction to your income tax bill. The halving of the incentive is sadly not the only revision reports Electrek.

The credit would offer certain citizens a 30 percent refundable tax credit if they purchased an e-bike under 4000. The Electric Bicycle Incentive Kickstart for the Environment Act creates a consumer tax credit that can cover up to 30 of the cost of buying an eBike. At of 10-28-21 the tax credit plan under consideration is.

The Build Back Better bill includes a 12500 EV tax credit up from the current 7500 available to qualifying cars and buyers. Before you rush out to pick up your new e-bike however understand this. Individuals who make 75000 or less qualify for the maximum credit of up to 900.

Line 7 If you cannot use part of the credit because of the tax liability limit the unused credit is lost. Those who bought before were able to get a Federal tax credit of 4000 in addition to credits ranging from 1000 to 4000. The unused or excess credit cannot be carried back or forward to other tax years.

Get a rebate of up to 3000 with the purchase of a new electric vehicle. The proposed eligibility requirements for the EV tax credit are simple. 30 5000 bike price limit.

You can ride an electric bike if youre 14 or over as long as it meets certain requirements. 500000 for married couples.

Ebike News E Bike Tax Credits Back On Track New Schwinn And Gazelle E Bikes And Much More Electric Bike Report Electric Bike Ebikes Electric Bicycles E Bike Reviews

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

Understanding The Electric Bike Tax Credit

Tern S New E Bike Priced To Maximize Proposed Federal Tax Credit Bicycle Retailer And Industry News

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

Ebike News E Bike Tax Credits Back On Track New Schwinn And Gazelle E Bikes And Much More Electric Bike Report Electric Bike Ebikes Electric Bicycles E Bike Reviews

New E Bike Incentives Announced By Bc Government Bc Cycling Coalition

The Electric Vehicles We Need Now Are E Bikes Bloomberg

New Biden Plan Would Give E Bike Buyers Up To 1 500 In Tax Credits R Ebikes

E Bike Tax Credit What Is It And How Does It Work Quietkat Usa

/GettyImages-1139717357-20236dae817d4164bef9d05504059bc7.jpg)

E Bike Incentives In Tax Bill Are Laughable Compared To Those For Electric Cars

Biden S Compromise Legislation Platform Returns E Bike Tax Credit To Original Rate Bicycle Retailer And Industry News

Another Eu Country To Offer 3 000 For An E Bike When Trading In An Old Car

Best Electric Bike Financing Options In Canada Easy E Biking

Tax Credits Jump To 1 500 For E Bikes 7 500 For Electric Motorcycles In Build Back Better Act R Ebikes

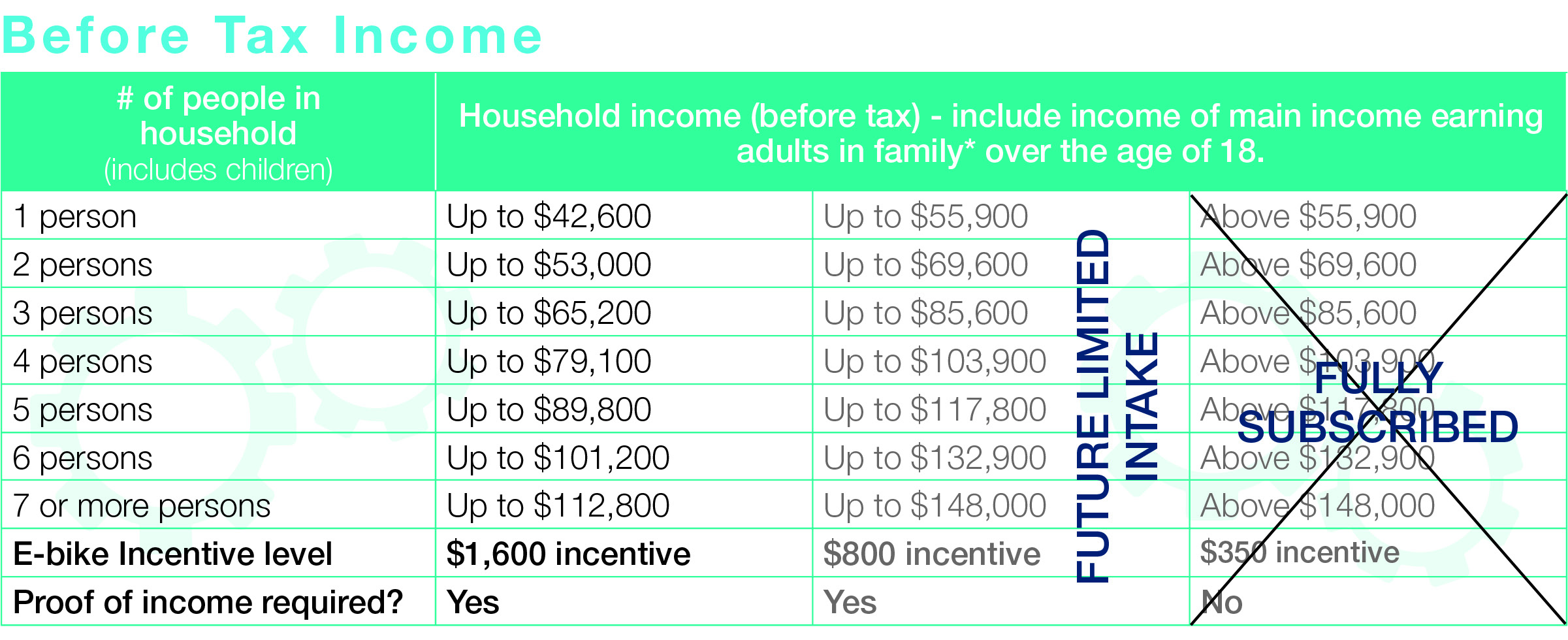

E Bike Incentive Pilot Program District Of Saanich

House Committee Advances Electric Bicycle Tax Credit And Bike Commuter Benefit Peopleforbikes

:max_bytes(150000):strip_icc()/comparison-44a635d15c28423a9840966341963b2b.jpg)

E Bike Incentives In Tax Bill Are Laughable Compared To Those For Electric Cars

What Makes A Good Electric Bike Incentive Program Peopleforbikes