refinance transfer taxes new york

Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded. What is the real estate transfer tax rate in New York.

Saving New York State Mortgage Recording Tax Gonchar Real Estate

Pickup or payoff fee.

. Pickup or payoff fee. Because the sales price is below 499999 the total transfer tax rate would be 14. Ad There May Never Be a Better Time To Refinance Your Home.

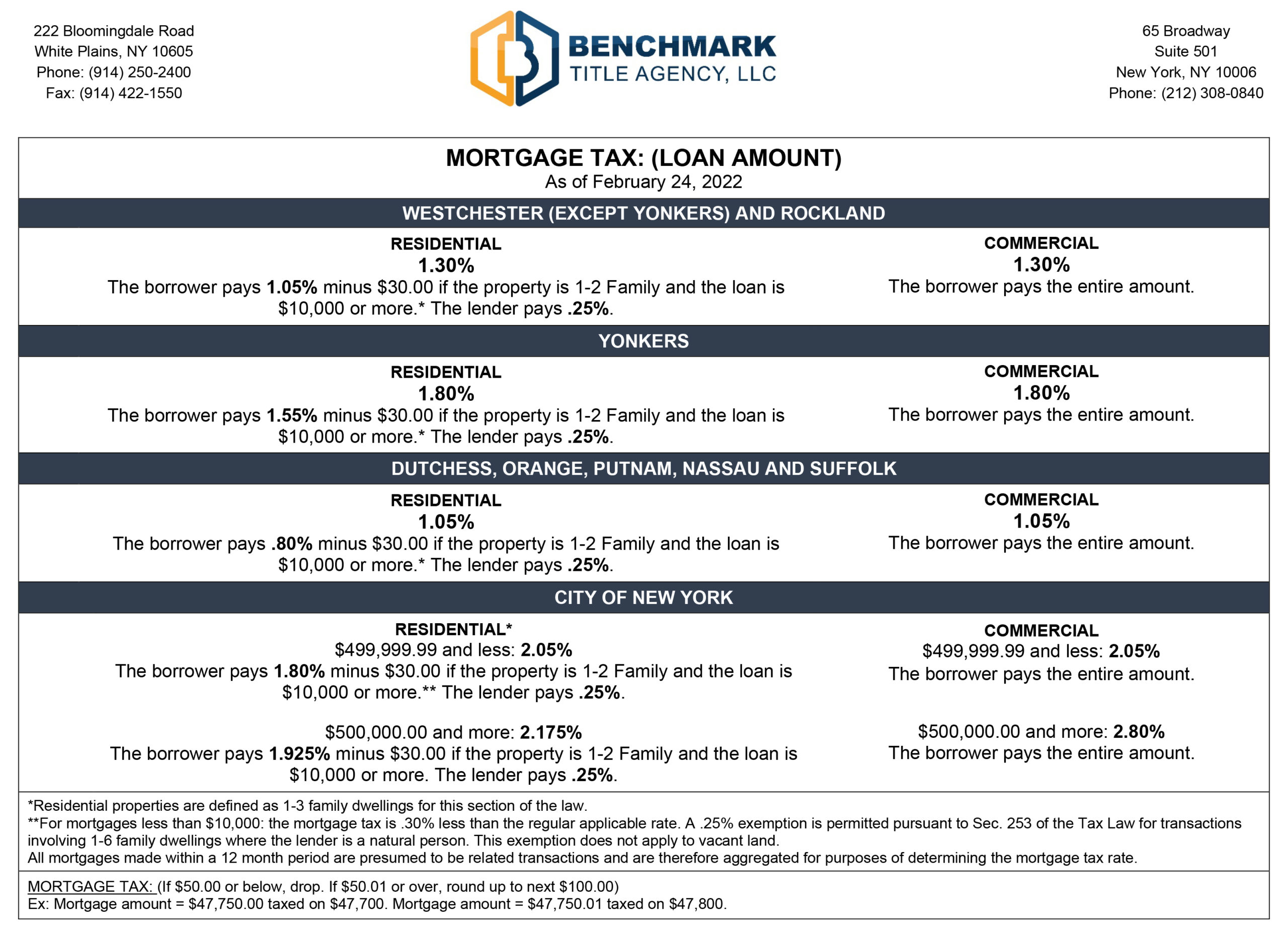

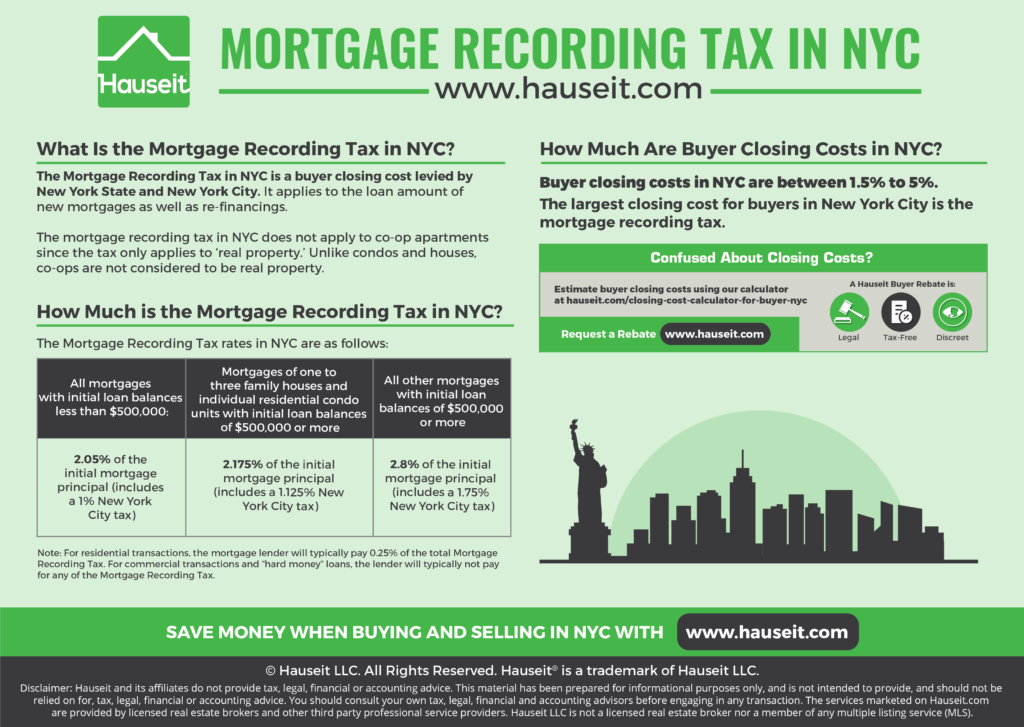

The tax must be paid again when refinancing unless both the old lender and the new lender accept the Consolidation Extension Modification Agreement CEMA process. Lender Pays Part of the Mortgage Recording Tax. Along with the state tax New York City Yonkers and several counties apply an additional local tax on recording a mortgage.

The New York State Transfer Tax is 04 for sales below 3 million and 065 for sales of 3 million or more. An additional tax of. Transfer tax differs across the US.

Recorded Mortgage on Full Refinanced Amount. Its the sum of the New York state transfer tax 04 and the NYC transfer tax 1. For 2021-22 the fixed interest rate is 628 compared to 373 for subsidized and.

Transfer tax on refinance in new york. Refinance transfer taxes new york Saturday. For New York City the tax rate and amount of tax due depends on the type of property involved and the amount of consideration.

Thats 1528750 in savings. In New York State. The rate varies by county with the minimum being 105 percent of the loan amount.

The rate is highest in New York City where borrowers pay 18 percent of the loan. For transfers of economic interests in. For example you may have to pay a mansion tax on apartments at or above 1 million transfer tax title insurance a lien search for co-ops andif you are getting a loana.

5 rows New York State also applies a 04 transfer tax on all properties. You can make sure the seller understands that they will likewise be saving for them as well because they will have reduced New York State transfer taxes which are typically 04. New York State transfer tax.

For example Colorado has a transfer tax rate of 001 while people. Parent PLUS loans have higher interest rates and fees than other federal loans. What are refinance transfer taxes.

Basic tax of 50 cents per 100 of mortgage debt or obligation secured. The higher rate of 065 kicks-in at a lower threshold of 2 million. 205 of the initial mortgage principal includes a 1 New York City tax Mortgages of one to three family houses and individual residential condo units with initial loan.

Additionally in 2019 NYS. In a refinance transaction where property is not. The New York State transfer tax rate is.

50000 x 18 900. This tax is levied on both home purchases and mortgage refinances which means you. Special additional tax of 25 cents per 100 of mortgage debt or obligation secured.

New York State equalization fee. In NYC the mortgage recording tax ranges from 18 1925 of the mortgage amount. Real Property Transfer Tax Filing Extensions and the COVID-19 Outbreak.

In NYC this tax ranges from 18 1925 of the. Rather than the Seller paying transfer tax on the full sale price the transfer tax is the sale price less the amount of the mortgage obtained by Buyer. You must pay the Real Property Transfer Tax RPTT on sales grants assignments transfers or surrenders of real.

Rather than the Seller paying transfer tax on the full sale price the transfer tax is the sale price less the amount of the. Ad There May Never Be a Better Time To Refinance Your Home. Saving New York State Mortgage Recording Tax Gonchar Real Estate Refinancing Your House How A Cema Mortgage Can Help.

Wordle Has Officially Moved To The New York Times Here S What You Need To Know

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Annual Report On Capital Debt And Obligations Office Of The New York City Comptroller Brad Lander

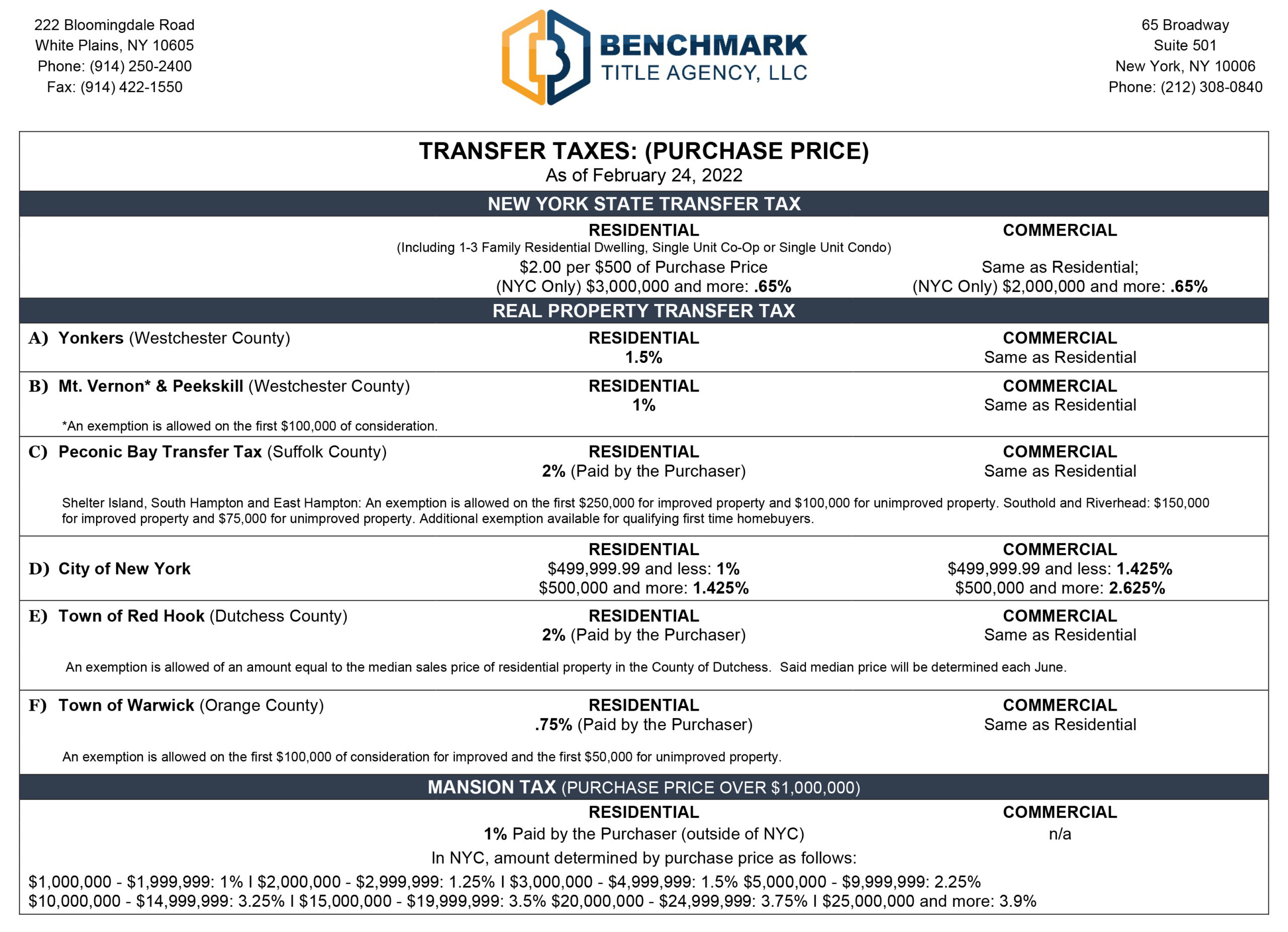

Mortgage Tax Transfer Tax Benchmark Title Agency Llc

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Real Estate Transfer Taxes In New York Smartasset

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Nyc Transfer Tax What It Is And Who Pays It Streeteasy

Nyc Transfer Tax What It Is And Who Pays It Streeteasy

Reducing Refinancing Expenses The New York Times

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

10 Reasons To Move To Delaware Home Buying Tips Delaware Moving

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Mortgage Tax Transfer Tax Benchmark Title Agency Llc

A Comprehensive Guide To The Nys And Nyc Transfer Tax Yoreevo Yoreevo

Comments On New York City S Preliminary Budget For Fiscal Year 2022 And Financial Plan For Fiscal Years 2021 2025 Office Of The New York City Comptroller Brad Lander